US stocks rose Friday evening, building on a stellar November, even as investors digested a warning from Central bank Seat Jerome Powell that it would be “untimely” to presume that Took care of rate hikes are finished or “speculate” when cuts could begin.

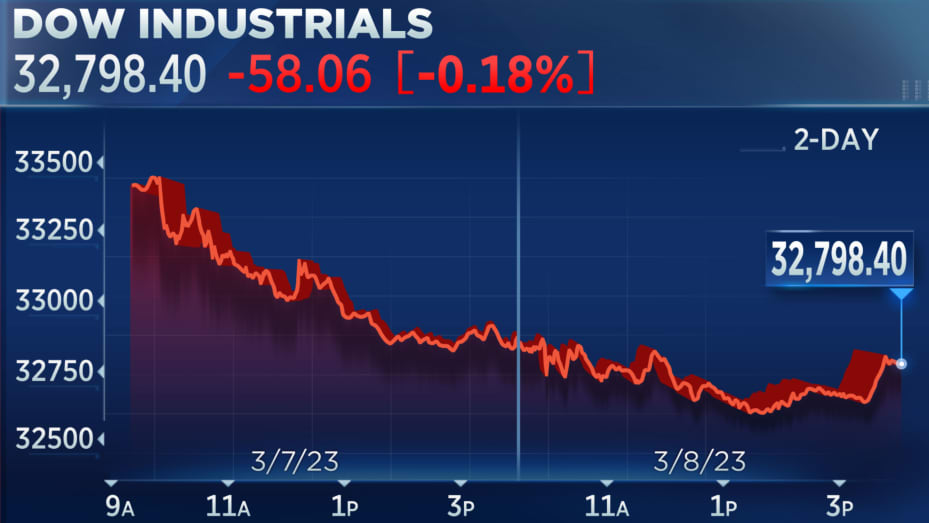

The S&P 500 (^GSPC) increased around 0.6% to another 2023 closing high, while the Dow Jones Industrial Normal (^DJI) rose generally 0.8% or almost 300 points. The tech-weighty Nasdaq Composite (^IXIC) progressed 0.5%. Every one of the three indexes closed positive for a fifth straight week.

Stocks soared in November to post their best month to month execution since 2022 as conviction that the Federal Reserve was finished with rate hikes transformed into growing hopes for rate cuts before the summer.

“It’s quite possibly of the best month we’ve seen in the last 10 years,” eToro US investment analyst Callie Cox told Hurray Finance Live. “And I think it shows us how a great deal of investors were surprised by the Federal Reserve’s adaptable stance after the Nov. 1 meeting.”

Powell spoke Friday after October information showed inflation cooled to its lowest levels since 2021. Despite his pushback against discuss rate cuts, markets moved higher from before losses as he hinted the central bank should be possible with rate hikes.

In the mean time, oil prices lost more ground after OPEC+’s extra result curbs neglected to convince skeptical investors. WTI unrefined futures (CL=F) exchanged just above $74 a barrel, down more than 2%, while Brent (BZ=F) futures were beneath $83.

Stocks finish higher after Powell urges alert

Money Street expanded stock gains on Friday, kicking off December with a bang. While Took care of Seat Powell encouraged investors that it was “untimely” to expect imminent rate cuts, the market pushed ahead, interpreting his cautious remarks in a positive light. The Federal Reserve is supposed to hold rates steady at its next approach meeting in less than two weeks. And many on Money Street still accept the central bank is probable finished with rate hikes, even as Powell said they are still possible.

The S&P 500 (^GSPC) rose generally 0.6%, while the Dow Jones Industrial Normal (^DJI) high level 0.8% or almost 200 points. The tech-weighty Nasdaq Composite (^IXIC) gained close to 0.6%.

A glance at the week ahead

Demoralizing interest rates and paltry home inventory have squeezed the US housing market, as the two buyers and sellers hesitate to take actions in a challenging business sector. Perhaps of the largest home developer will provide investors with the latest read on the fate of property construction, as Cost Brothers (TOL) plans to report earnings in the coming days.

Retail market observers will also get new information and forecasts from enormous chains including Dollar General (DG) and Luluemon (Humdinger). Their earnings follow several weeks of retail reports that based on a topic of a really discerning, debilitated American consumer.

Investors will also get further insight into the work market with the release of the Employment opportunities and Work Turnover information for the long stretch of October. Likewise, the finish of the following week will also bring the November jobs report, a key indicator that will steer the heading of the Central bank’s tightening effort.

Hurray Finance’s Brent Sanchez has a graphical breakdown of what to watch one week from now:

Apple and Principal in talks to package services

The television group that long defined the entertainment industry is getting a second life, essentially among streaming services that are putting their own spin on packaging different services to customers.

Apple (AAPL) and Vital (PARA) have discussed bundling their streaming services at a discount, the Money Street Diary reports, as companies attempt to slice through a jam-packed field and customers pull back on subscribing to various services.

The potential combination would cost less than the paying for the two services separately, according to the report, and the details are still muddled.

Entertainment companies continue to confront pressure as customers are saturated with choices and the streaming business matures. Analysts foresee consolidation not too far off, and Foremost specifically is seen as a potential acquisition target. Streamers have also increased prices and embraced promotion supported plans to juice income.

The advantage of a bundling strategy stems from discounted pricing for customers and a more robust item offering from streamers. While some customers could chose to sign on to a service and then drop subsequent to binging a show, a group might offer a really compelling reason to stay, with a bigger library and access to additional exclusive shows and movies.

Stocks trending in evening time trading

Here are some of the stocks leading Yippee Finance’s trending tickers page during early evening time trading on Friday:

Fundamental (PARA): The entertainment organization rose over 9% Friday early evening time following a Money Street Diary report that Central and Apple (AAPL) are in talks to package their streaming platforms possibly. The proposed Apple TV+/Paramount+ combo service would almost certainly be more reasonable than having the two services separately, and would give customers access to exclusive substance across the two catalogs.

Pfizer (PFE): Shares of the drug monster fell by 6% on Friday morning after the organization said it wouldn’t push ahead with a study of its two-dose obesity treatment, following an elevated degree of side effects in patients involved in the trials.

Coinbase (COIN): Shares of the crypto stage rose over 6%, building on impressive returns for the year following a significant settlement between US authorities and Binance that analysts say has resolved a level of uncertainty that had loomed over the industry. Coinbase is trading at approximately four times the cost at which it started the year.

Bitcoin (BTC-USD): The world’s largest cryptocurrency rang in December with optimism as it broadened a convention that is approaching a 19-month high as investors bank on endorsement of a spot exchange-exchanged fund that would invite more capital investments to the industry. Bitcoin rose almost 2% to surpass $38,000.

Stocks tick up even after Powell chills rate cut jabber

Central bank Seat Jerome Powell cautioned that it would be “untimely’ to presume that rate hikes are finished or “speculate” when cuts could begin.

In pre-arranged remarks at Spelman School in Atlanta on Friday, Powell chilled hopes that the central bank would soon proclaim triumph in its battle to control inflation. However, investors seemed to accept the cautious comments, as the significant indexes ticked higher in the final hour of morning trading.

Powell’s comments follow a fresh perused on the Federal Reserve’s leaned toward inflation measure — the center Personal Consumption Expenditures index — that showed inflation is continuing to slowly descend, Hurray Finance’s Jennifer Schonberger reports. Center PCE got started at 3.5% for the period of October, down from 3.7% in September, continuing a descending pattern from 4.3% back in June.

The full effects of the Federal Reserve’s aggressive rate hikes have likely not yet been felt, he said. That suggests the Fed will hold interest rates steady at its next meeting in less than two weeks.

Stocks exchange higher in evening session

Money Street built up speed on Friday early evening time following remarks from Took care of Seat Jerome Powell in which he chilled hopes of an imminent rate slice and a finish to the tightening effort.

The S&P 500 (^GSPC) increased around 0.5%, while the Dow Jones Industrial Normal (^DJI) rose generally 0.7% or in excess of 200 points. The tech-weighty Nasdaq Composite (^IXIC) progressed 0.4%.

Tesla stock falls after Cybertruck debut

Tesla’s (TSLA) eagerly awaited Cybertruck has shown up as the organization conveyed its first cluster of the vehicle to buyers. On first blush the market didn’t seem impressed; shares of the all-electric automaker fell 2% in morning trading Friday.

The slide also comes after Chief Elon Musk faces the aftermath from his interview at the New York Times (NYT) DealBook gathering recently, in which he cursed advertisers fleeing his social media organization X.

Drivers interested in the Cybertruck base model should hand more than $60,990, over 50% more than the organization estimated years prior when it reported the new model. “That just isn’t a huge segment of the populace that can manage the cost of that especially where interest rates are,” said Jessica Caldwell, head of insights at auto research firm Edmunds.

The truck’s send off caps off a topsy-turvy year for Tesla, Yippee Finance’s Josh Schafer reports, which has seen its stock cost soar on the possibilities of its computerized reasoning goals while also coming under tension in the midst of different value cuts and weakening margins.